Insights|

Lakestar, Walden Catalyst and Dealroom launch the 2025 European Deep Tech Report

The report aims to align Europe's definition of Deep Tech, examine the characteristics of the European ecosystem, dive deep into key areas of Deep Tech, and lay out ways it can enhance its global competitiveness.

Access the report

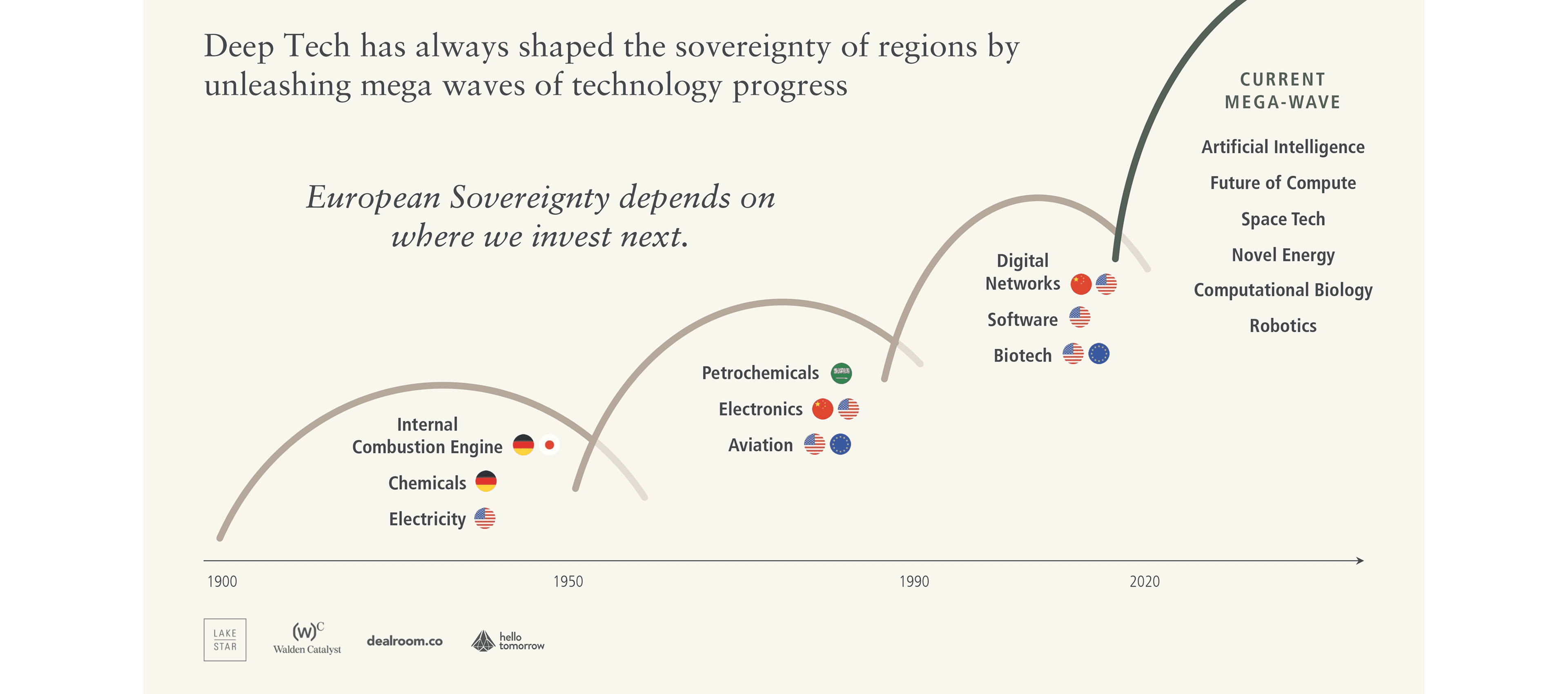

Deep Tech will shape the next waves of geopolitics in Europe

Deep Tech is instrumental in tackling today’s biggest global challenges, from climate change and food security to pandemics and cybersecurity threats, and war. The report emphasizes that solving such colossal problems requires fundamentally new scientific and engineering breakthroughs, not just incremental improvements to existing technology. Throughout history, breakthrough innovations (electricity, the internal combustion engine, the transistor, etc.) have unleashed “mega-waves” of progress that created entirely new industries and shaped geopolitics and the sovereignty of nations. Europe’s ability to ride the next wave of Deep Tech will shape its geopolitical standing.

Despite its promise, Deep Tech is often times misunderstood

The report debunks several common misconceptions with data and examples:

Do Deep Tech companies need more capital?

Deep Tech startups do need more upfront capital than, say, a software app, but most of that capital goes into R&D and IP (building defensible technology moats) rather than into splashy marketing. These heavy investments in labs, talent, and infrastructure can actually become an advantage – they create high barriers to entry for competitors. Once the tech is developed, Deep Tech companies can scale more efficiently, leveraging their IP, rather than continuously burning cash on user acquisition.

Do Deep Tech companies need more time to exit?

Deep Tech ventures often have longer R&D timelines and may take more time to reach initial revenue, but when the breakthrough finally works, growth kicks into high gear. The report notes that once the technology matures, revenue growth often accelerates rapidly, sometimes outpacing that of “regular” tech companies. In fact, early data suggests that well-run deep tech portfolios outperform conventional tech in the long. While the exit landscape is still developing (few deep tech IPOs so far, and M&A has been modest), there are notable successes (e.g. Northvolt’s multibillion valuation), and overall returns are trending positive. In short, patience can pay off handsomely with Deep Tech.

Do Deep Tech companies fail more often?

Deep Tech companies do not have an abnormally high failure rate. Their failure rates are comparable to other startups – the difference is in the type of risks they face. Deep Tech teams grapple with scientific uncertainty and longer development cycles, but they are less likely to be outcompeted by a quick copycat, as often happens in traditional SaaS companies. The report urges investors to understand this distinct risk profile rather than assume Deep Tech is a moonshot gamble. With proper support and risk management, Deep Tech startups can be just as viable as any other sector.

Europe has everything it needs to build a flourishing Deep Tech ecosystem and determine

Europe has a unique opportunity to lead in Deep Tech thanks to its inherent strengths. The continent boasts a concentration of world-class research institutions and talent – six of the world’s top 20 universities and nine of the top 25 research institutes are European. This strong science base means a constant pipeline of cutting-edge discoveries and highly skilled graduates. Europe’s industry expertise and corporate support are also key assets: major companies like Siemens and Bosch act as early customers and champions for local deep tech innovationf, providing startups with market access and resources. Additionally, Europe’s workforce is highly trained, and the region has strong manufacturing know-how in fields like advanced engineering and semiconductors. These ingredients – top-tier academia, talent, and active corporates – form a solid foundation for a thriving deep tech ecosystem.

Moreover, for investors, Deep Tech provides a hedge against momentum investing

Deep Tech remains the largest and one of the most resilient venture investment categories in Europe. In 2024, about €15 billion flowed into European deep tech startups – only a 28% decline from the 2021 peak, even as overall tech VC funding plummeted ~60% in the same periodf. By contrast, many “traditional” tech sectors saw far steeper drops, highlighting how Deep Tech investment has proven more resilient during market downturns. In fact, Deep Tech is now the single largest category in European venture capital by funding, accounting for roughly one-third of all VC investment on the continent. This momentum is widespread across Europe: the UK (~$4.2bn), France (~$3.0bn), and Germany (~$2.7bn) were the top countries for deep tech funding last year, with innovation hubs like London, Paris, and Munich serving as primary centres of activity. Even amid a global tech slowdown, Europe’s deep tech sector has attracted sustained capital and attention, underlining its strategic importance and the continent’s potential to claim global leadership in these fields.

Select Deep Tech domains will drive the next era of innovation in Europe and determine tomorrow’s geopolitical winners

The report identifies a set of major Deep Tech domains that are poised to drive the next era of innovation – and with it, influence global power dynamics. These high-growth areas include advances in artificial intelligence, computing hardware, space and defense tech, robotics, biotechnology, and energy. Mastery of these fields is not just an economic opportunity but a strategic imperative: European sovereignty depends on where we invest next, as nations that lead in these technologies will define the future in terms of security and competitiveness. In the report, seven key sectors are highlighted:

- Novel AI – Cutting-edge artificial intelligence, including generative AI and foundation models. This is Europe’s fastest-growing deep tech segment, with about $3.0 billion invested in 2024 (a 100% year-over-year increase). Breakthroughs in AI (e.g. new large language models or AI agents) are viewed as fundamental to future economic growth and national security.

- Future of Compute – Next-generation computing technologies that power AI and data processing, from advanced semiconductors to quantum computing and photonics. This segment saw roughly $1.2 billion in funding (flat year-over-year), as Europe pushes to develop its own chips and quantum platforms. Leadership in compute is vital to reduce dependency on foreign hardware and cloud infrastructure.

- Space Tech – The new space race, including small satellite constellations, launch vehicles, and in-space services. European space tech investment reached $1.0 billion in 2024 (up 20%). With space now recognised as critical infrastructure for communications, navigation, and observation, having indigenous capabilities (rockets, satellites, etc.) is increasingly tied to geopolitical influence and security.

- Robotics – Advanced robotics and autonomous systems for industry, agriculture, transportation, and defense. European robotics startups raised about $700 million last year (+15%). Progress in robotics (from factory automation to autonomous systems and foundational models for robotics) will boost productivity and has dual-use applications in both commercial and military domains.

- Computational Biology & Chemistry – The convergence of AI and computing with life sciences and materials science. This includes AI-driven drug discovery, protein folding (as demonstrated by DeepMind’s AlphaFold), synthetic biology, and chemical modelling. Funding for “CompBio” startups was $500 million in 2024 (up 50%). These technologies are crucial for healthcare innovation, pandemic response, and biosecurity, as well as for developing new materials and sustainable chemicals.

- Novel Energy – Breakthroughs in energy generation and storage, vital for climate goals and energy independence. In 2024, $1.1 billion (+70% YoY) was invested in novel energy tech. This covers areas like fusion energy, small modular nuclear reactors (SMRs), advanced battery chemistries, and hydrogen technology. Success in novel energy can help Europe address climate change while reducing reliance on imported energy sources.

- Defence/Dual Use – New defense technologies and dual-use innovations (those with both civilian and military applications). European startups in defence-related tech (AI for defence, drones, autonomous vehicles, cyber-defence, etc.) attracted $653 million in 2024, doubling from the previous year. With rising security threats, investments in defence tech are directly linked to national sovereignty. For instance, European nations are increasing budgets for defence AI and unmanned systems, seeking to not be outpaced as the US and China pour resources into these areas. Many deep tech innovations – from AI to quantum encryption – will heavily influence military capabilities and geopolitical leverage.

Collectively, these seven domains represent the “next wave” of deep tech innovation that will shape the global landscape in the coming decades. The report stresses that Europe’s standing in the world will increasingly hinge on its prowess in these fields. Securing leadership in these sectors is critical for Europe to control core technologies and supply chains, protect its citizens, and maintain economic strength in an era of intense geopolitical competition today’s deep tech domains will determine tomorrow’s geopolitical winners and losers.

Read the report