Insights|

How Lakestar supports its companies

Entrepreneurship is difficult. This is why Lakestar has developed a pastoral role for its portfolio companies to advise and accompany them on their growth journey. For Lakestar, this offers it a learning process into how the company works, while the portfolio company gains added value in the form of expertise, networks and advice.

Lakestar’s involvement can start long before it makes an investment. ‘As an investor you want a good idea of the founder,’ says Mika Salmi, Lakestar’s managing partner. ‘You want to see how they do their journey, how they meet their goals and how they execute. Just investing in a company you have only known for three months is a bit like flying blind – you don’t know how they got there. That’s why we want to track a company over a long period of time, see who are the strong founders and who are not.’

Once on board in Lakestar’s portfolio, a company can expect a whole range of assistance. ‘Companies have evolving needs throughout their lifecycle,’ says Ninja Struye de Swielande, Lakestar’s partner responsible for communications and marketing. ‘At first, when they are smaller we help them with their first press announcement, typically when they do their Series A. That includes helping write it as well as distributing to the right media targets and journalists that we have good relationships with.’ Assistance in communications in particular can help clarify the company’s growth mindset and goals.

We are not just concerned with investing, we also follow the full journey with an investment.

‘We are not just concerned with investing,’ says Christoph Schuh, Lakestar’s go-to-market partner. ‘We also follow the full journey with an investment. This means it’s about the right sourcing, pitching into deals, developing the companies and then exit.’

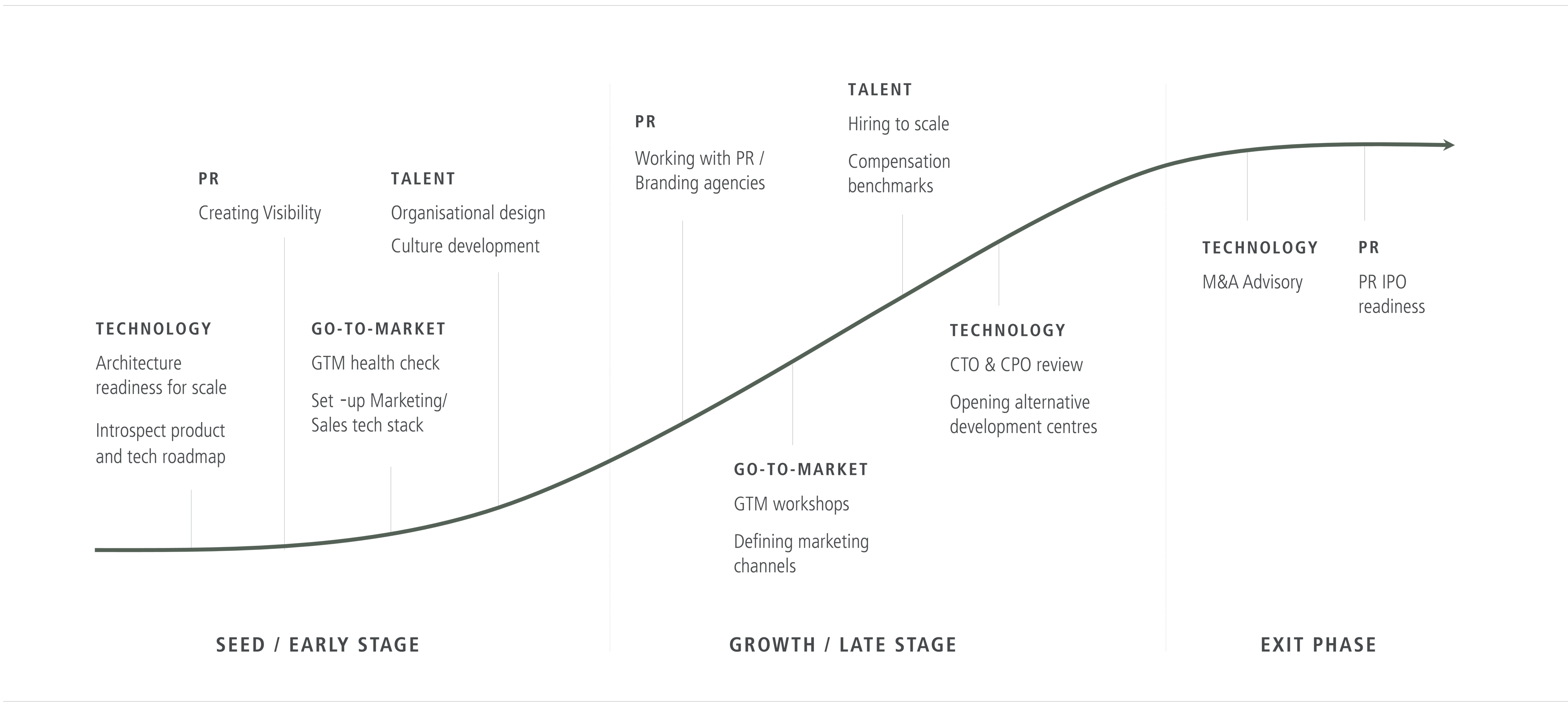

How Lakestar works with its companies along the investment phases

He says Lakestar has created proprietary software in the form of a dashboard that monitors the performance of each company. ‘It works on a traffic light system and offers different dimensions such as financial performance, go-to-market, and team. We look at the company from two perspectives: one is value-add and the other is exit. With quarterly meetings and the dashboard, we feel well prepared to control and monitor our portfolio companies.’

One of the most common challenges that Stephen Nundy, technology partner, sees is helping the company to change its mindset. ‘What comes up time and time again is “what got them here is not going to get them there”,’ he says. A company has to keep evolving and not be afraid to change, he adds. ‘We help founders think proactively about change long before it is going to happen. Many of us have gone through these experiences ourselves before we joined Lakestar so we can work empathetically with the founder.’

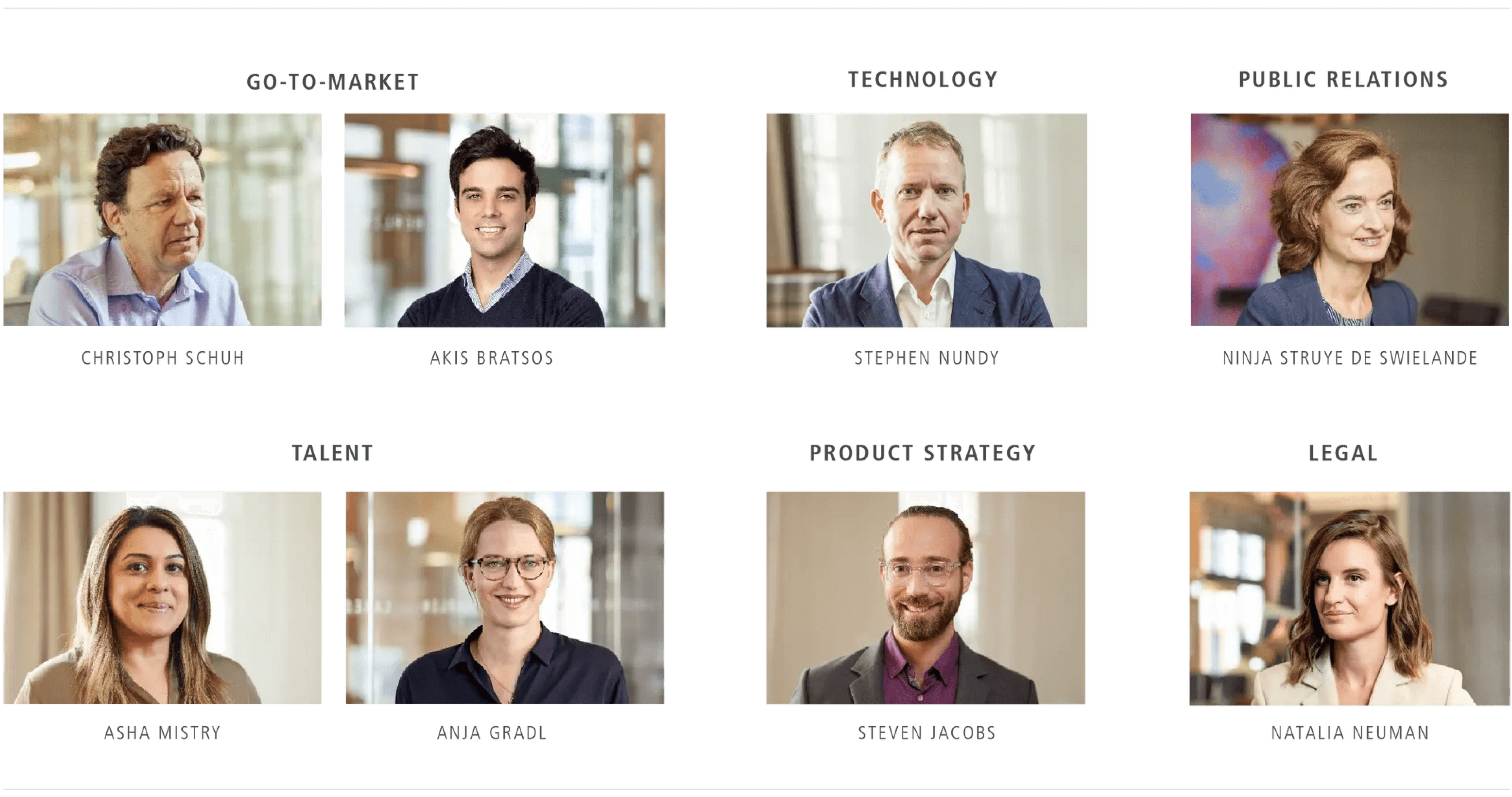

Asha Mistry, Head of Talent, and Steven Jacobs, Venture Partner Lakestar

Lakestar also helps companies recognise that their needs evolve as they grow. For example, Asha Mistry, Head of Talent, says: ‘At the earlier stages, founders often hire from their own network, and look for potential in candidates. As the company grows you need to hire for skills and experience so you can build your infrastructure to scale faster’. She advises our portfolio companies on human capital management, from hiring, culture development, building talent assessment frameworks through to supporting with interviews.

‘We have all the access to data such as compensation benchmarking and benefits,’ she says. ‘For hiring senior roles such as CMO or Chief Revenue Officer companies often ask us to do the interviewing from a shortlist of candidates,’ says Christoph Schuh. ‘We don’t decide for them on which candidate to appoint, but they get an open and trustful feedback from us.’

Another challenge that a company faces as it scales is how to handle its product. ‘Very early in a company’s history the CEO is the head of product. They have the idea, they raise capital and they search for the product market fit,’ says Steven Jacobs, who runs Lakestar’s product strategy. ‘For the ones that are successful, the founding team then have a lot of responsibilities that get layered on top of the product itself. They need a more autonomous team in terms of product strategy. That’s a challenging shift for many early-stage and growth-stage companies.’

He says that as well as offering advice and experience of best practice, he facilitates self-help in the form of workshops and getting founders from different companies together to share experiences and support each another.

The Lakestar value creation team

Long before a company approaches the go-to-market stage, Lakestar seeks to optimise its composition and timing. Christoph Schuh says: ‘We have created a framework for go to market, meaning we have analysed more than 400 companies and KPIs which we have in the database. We can look into our database and KPIs and assess whether the company is on track and whether the marketing and sales team mix is the right one to achieve the results they expect.’ He adds that Lakestar also models the path towards going to market, including the size of marketing spend and sales team. ‘We give them an open-minded trusted feedback and leave it up to them. We don’t say “this is how you do it”,’ he says.

He cites HomeToGo, the vacation rental marketplace, as a recent example of how Lakestar helped facilitate an exit that was very successful for both sides. Lakestar had invested in HomeToGo in 2018, based on the thesis, that vacation rental will become a long-term trend and that the market needs an aggregator and an operating system for that fragmented market. Covid accelerated the company’s revenue growth. Although HomeToGo originally planned to go public in 2022/23, it was being courted by many SPAC sponsors. The management decided to create a proper bidding process and contracted Morgan Stanley to find the best sponsor for it. ‘Lakestar SPAC I was one of the potential sponsors and HomeToGo decided to go with that because it was a European sponsor and because they have known us for years and there was a lot of trust in our relationship,’ says Christoph Schuh. The company went public on the Frankfurt Stock Exchange in June 2021 with a market capitalisation of around EUR1 billion. ‘With the SPAC they got access to EUR250 million in extra cash to invest in growth, and much earlier than they thought.’

This article is part of the Lakestar Briefing, a periodical publication about Lakestar's portfolio companies and our network of inspiring minds we like to work with.

Click here to subscribe